RBI's policy rate cut to boost growth as inflation eases: BoB report

ANI

11 Jun 2025, 23:13 GMT+10

New Delhi [India] June 11 (ANI): The decision of the Reserve Bank of India (RBI) to slash the policy rate will boost growth amidst easing price pressures and infuse liquidity along with supporting credit flow, said a report by Bank of Baroda.

The BoB report added that the RBI's surprise 50 basis-point rate cut, along with a phased 100 basis-point reduction in the Cash Reserve Ratio (CRR), has signalled a strong pro-growth stance.

The announcements have been welcomed by markets and are expected to spur economic activity in the coming quarters.

The Monetary Policy Committee (MPC) maintained its GDP growth forecast for FY26 at 6.5 per cent. The RBI revised the inflation projection downward to 3.7 per cent, highlighting its confidence in the current macroeconomic environment.

On June 6, RBI's Monetary Policy Committee (MPC) reduced the policy repo rate under the Liquidity Adjustment Facility by 50 basis points to 5.5 per cent.

Consequently, the Standing Deposit Facility Rate, which is the SDF Rate, shall stand adjusted to 5.25 per cent, and the Marginal Standing Facility MSF Rate and the Bank Rate shall stand adjusted to 5.75 per cent.

'These measures are expected to boost growth amidst easing price pressures and infuse liquidity along with supporting credit flow,' the report added.

'In the coming week, focus would shift towards the US Fed, wherein a pause is expected, especially since the labour market has been signalling some strength,' the report added.

India's monetary move comes against a backdrop of renewed optimism in the global economy, as the United States and China begin working towards concluding new trade terms.

The report added that global central banks have adopted a watchful stance, closely monitoring the inflation risks with growth.

'Global central banks closely monitored the evolving dynamics between growth and inflation,' the report added.

The European Central Bank (ECB) recently cut rates by 25 basis points.

As per the report, the attention now turns to the US Federal Reserve, which is widely expected to pause its rate changes given recent labour market resilience.

'In the coming week, focus would shift towards the US Fed, wherein a pause is expected, especially since the labour market has been signalling some strength,' the report added. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Calgary Monitor news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Calgary Monitor.

More InformationNorth America

SectionSouth Korea silences loudspeakers in gesture toward North

Newly elected President Lee Jae-myung has declared that he wants to diffuse tensions with Pyongyang South Korea's newly elected President...

RBI's policy rate cut to boost growth as inflation eases: BoB report

New Delhi [India] June 11 (ANI): The decision of the Reserve Bank of India (RBI) to slash the policy rate will boost growth amidst...

Aston Martin driver Lance Stroll (hand) to return for Canadian GP

(Photo credit: Peter Casey-Imagn Images) Aston Martin driver Lance Stroll will drive in his home-nation race, the Canadian Grand...

Trump 'Less Confident' About Nuclear Deal As Iran Warns Against War

US President Donald Trump said his confidence in securing a nuclear deal with Iran has waned, but he vowed Tehran would never acquire...

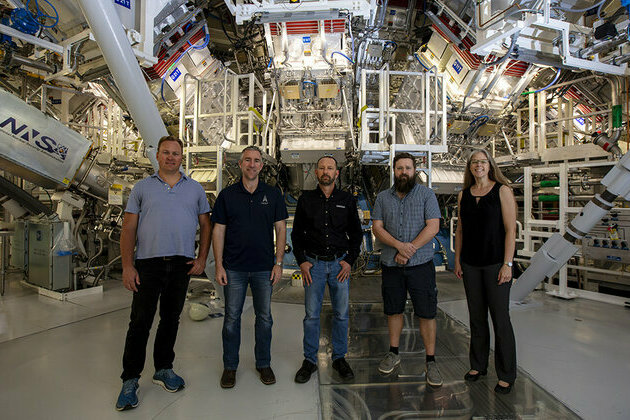

US Laboratory Team Leader Wins IAEA Nuclear Fusion Prize for 2024

A paper on fusion neutron sources by a team from the United States of America’s Lawrence Livermore National Laboratory and the University...

US faces steeper crude oil production decline than previously anticipated: S&P Global Commodity Insights

New Delhi [India], June 11 (ANI): The US is facing a deceleration of crude oil production growth in 2025 than previously anticipated,...

Canada

SectionAustralian PM rejects US pressure to ease biosecurity rules

SYDNEY, Australia: Australia will not ease its strict biosecurity rules during trade talks with the United States, Prime Minister Anthony...

WWII heroes visit Normandy, say freedom still worth fighting for

OMAHA BEACH, France: Eighty-one years after the D-Day landings, a small group of World War II veterans has returned to the beaches...

Summer travel slows as Americans hunt for last-minute bargains

WASHINGTON, D.C. Forget bucket lists; this summer, it's all about budget lists. Amid economic uncertainty and a weaker dollar, Americans...

Aston Martin driver Lance Stroll (hand) to return for Canadian GP

(Photo credit: Peter Casey-Imagn Images) Aston Martin driver Lance Stroll will drive in his home-nation race, the Canadian Grand...

Resilient, sustainable food systems are Canada's best defence against American tariffs

Earlier this year, Donald Trump's administration in the United States reimposed tariffs on Canadian items, including agricultural products,...

(SP)CANADA-TORONTO-FOOTBALL-CANADIAN SHIELD TOURNAMENT-CANADA VS COTE D'IVOIRE

(250611) -- TORONTO, June 11, 2025 (Xinhua) -- Nicolas Pepe (L) of Cote d'Ivoire vies with Derek Cornelius of Canada during the Canadian...